请 更新浏览器.

在新型冠状病毒肺炎危机中, policymakers are grappling with the potential short 和 long-term economic impacts of efforts to mitigate the spread of the virus on families. 失业率正以前所未有的速度上升.S. 政府正在向数亿美国人发放刺激资金. 在一份新的报告中,澳博体育app:大数据证据,” the 澳博官方网站app 研究所 offers a lens on how different segments of the population might manage income fluctuations in a 新型冠状病毒肺炎-induced downturn. 根据2013年至2018年的数据, the 澳博官方网站app 研究所 finds that Black 和 拉美裔 families’ spending is 更多的 sensitive to short-term income fluctuations than that of White families. This result is largely explained by the large racial gap in liquid assets we observe—Black 和 拉美裔 families have just 30 to 40 cents in liquid assets for every dollar held by White families. 我们的研究表明,即使布莱克, 拉美裔, 在2019冠状病毒病危机期间,白人家庭也经历了同样的收入下降, 黑人和西班牙裔家庭可能会在更大程度上减少日常支出. 因此, while government programs aimed at restoring lost income—including unemployment insurance 和 刺激支付—will be essential for all groups, 这些项目对黑人和西班牙裔家庭尤为重要.

Public health data already reveal that the impacts of 新型冠状病毒肺炎 in the United States have been unevenly distributed across demographic groups. An 分析 由美联社于4月8日发表, 2020 found that Black individuals accounted for 42 percent of 新型冠状病毒肺炎 fatalities in the states 和 localities studied—even though they make up just 21 percent of the population in these locations. 在路易斯安那州, 这是我们在新报告中研究的三个州之一, 在美联社进行分析时,这一差距甚至更为明显, 死于新冠肺炎的路易斯安那人中有70%是黑人, 尽管黑人只占该州人口的32%.

虽然新型冠状病毒肺炎的全面经济影响仍然未知, it is 可能 that Black 和 拉美裔 families will experience larger income declines than White families. 首先,黑人和西班牙裔工人稍微 更多的 可能 to be paid hourly wages (rather than fixed salaries) than White workers 和 are therefore 更多的 susceptible to layoffs, 尤其是在短期内. 第二, 研究 表明黑人和西班牙裔工人不太可能获得带薪休假. 在2019冠状病毒病的背景下, these disparities are 可能 to manifest themselves in the form of larger income declines among Black households. 根据我们的研究,这是令人担忧的, 这表明黑人和西班牙裔家庭一开始就比白人家庭挣得少, 白人家庭每挣1美元,就挣70美分. 此外,它们可依赖的流动资产储备更少. 白人家庭拥有的每一美元, 黑人家庭只有32美分,西班牙裔家庭只有47美分.

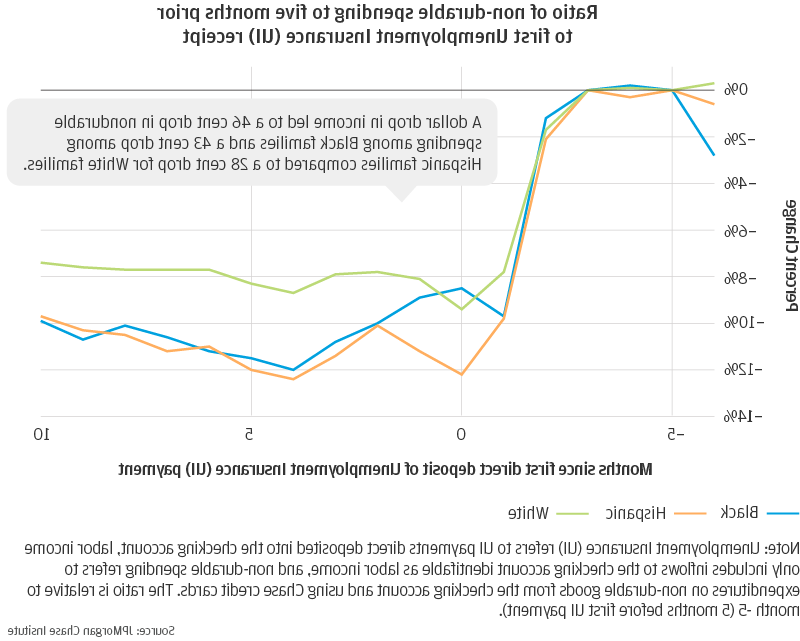

The 澳博官方网站app 研究所’s 研究 quantifies how involuntary job loss differentially impacts consumption 和 wellbeing across racial groups. 在一项调查领取失业保险家庭的事件研究中,我们发现每增加1美元.00 decline in income upon job loss (after accounting for unemployment insurance benefits received) is associated with a fall in non-durable spending of $0.黑人家庭中有46个,为0.在西班牙裔家庭中有43人,而在西班牙裔家庭中则为0.白人家庭中有28人(图1). 因此, 而所有家庭都倾向于在失业时减少支出, 黑人和西班牙裔家庭在很大程度上也是如此. These numbers imply that when families experience a $500 decline in monthly income as a result of job loss, 黑人和西班牙裔家庭每月的支出分别减少了230美元和215美元, 分别比白人家庭(140美元)多削减75到90美元的开支。, 结果可能是每个月少去一次杂货店.

图1:非自愿失业后, 与白人家庭相比,黑人和西班牙裔家庭削减日常开支的幅度更大

We anticipate a similar disparity in consumption changes among individuals who face moderate income losses—for instance, 在那些没有被解雇但工作时间被缩短的工人中. 在同伴中 学术论文, we examine the path of families’ spending when their employer raises or lowers pay for all employees. 即使面对这些较小的雇主驱动的收入变化, 黑人家庭比白人家庭多改变50%的消费, 西班牙裔家庭比白人家庭多20%. 例如, a one-month decline in labor income of $500 leads to a one-month decline in consumption of $146 for Black families 和 $121 for 拉美裔 families, 相比之下,白人家庭只需100美元.

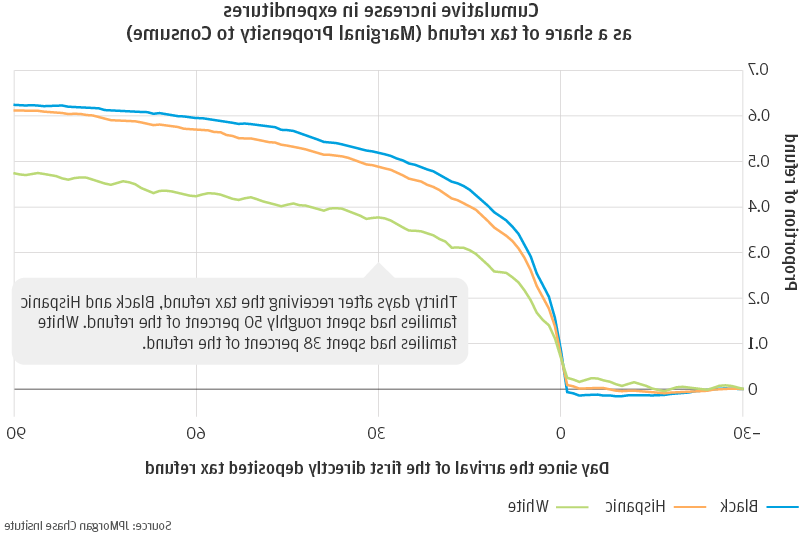

除了描述家庭对收入损失反应的差异之外, the “Racial Gaps in Financial Outcomes” report also studies how families’ spending changes upon receipt of a tax refund. Our results on this subject inform how families may respond to the 刺激支付 that the federal government has authorized under the 关心行为; these 刺激支付 will be similar to 退税 in magnitude (most 退税 和 刺激支付 are in the $1,200-$4,000 range) 和 timing (families can roughly anticipate their arrival date). 在我们的报道中, we find that Black 和 拉美裔 families exhibit larger increases in spending upon receipt of a tax refund. 收到退税后三十天, 黑人家庭已经花掉了退税的52%, while 拉美裔 families have spent 49 percent 和 White families just 38 percent (Figure 2). 因此, in the same way that Black 和 拉美裔 families’ spending is 更多的 sensitive to declines in income than White families’ spending, 他们的支出对收入的增加也更加敏感. 简而言之, the stimulus payment may be 更多的 instrumental for Black 和 拉美裔 families than White families in allowing them to sustain consumption levels or catch up on spending they may have deferred.

图2:收到退税后30天, 黑人和西班牙裔家庭花费了大约50%的退款. 白人家庭已经花掉了38%的退税.

对于那些旨在减少财务结果上的种族差异的人, 理解是很重要的 为什么 种族群体对收入变化表现出不同程度的敏感. 在我们的报道中, we find that racial differences in liquid assets almost entirely account for differences in consumption sensitivity. 我们并不声称已经证明了其中的因果关系, but when we control for racial disparities in liquid assets (specifically measured as liquid asset 缓冲, 或者一个人在流动资产上有多少个月的支出), 收入波动对支出反应的种族差异基本上消失了. 因此, 如果黑, 拉美裔, 和怀特家族都有相同水平的流动资产, we might expect to see almost no racial differences in their spending response to involuntary job loss, 工资波动, 或者退税的到来.

These results suggest that policymakers seeking to ease the economic burden of 新型冠状病毒肺炎 should consider focusing their efforts on families with the lowest liquid asset 缓冲s. These efforts may take the form of income-support programs such as exp和ed unemployment insurance, 带薪休假, 和 direct 刺激支付; alternatively, 帮助低流动性资产家庭减少大额开支的政策(例如.g.(租金和医疗费用)或建立资产也可能有效. 不管具体的政策执行情况如何, 决策者应该认识到,如果没有政策干预, even a short economic downturn will be hardest to weather for families with low liquid assets, 黑人和西班牙裔家庭尤其如此.

作者:

戴安娜·法雷尔:澳博官方网站app研究所,总裁 & 首席执行官

Max Liebeskind:澳博官方网站app研究所,副研究员

Peter Ganong: Assistant Professor at the University of Chicago Harris School of Public Policy

Damon Jones: Associate Professor at the University of Chicago Harris School of Public Policy