请 更新浏览器.

对许多人来说,拥有自己的房子是美国梦的重要组成部分. 促进自置居所, 在过去的80年里制定了许多政策, 抵押贷款已成为大多数购房者的首选融资工具.

The aftermath of the Great Recession was a particularly difficult period for many homeowners with a mortgage. The steep decline in home prices meant that by the end of 2011 many borrowers were “underwater”—they owed more on their mortgage than their home was worth. 在同一时期, 失业率几乎翻了一番,住房抵押贷款拖欠率飙升. 在回应, various mortgage modification programs were introduced to help homeowners struggling to make their monthly mortgage payments remain in their homes. 在澳博官方网站app研究所的这份报告中, we analyzed homeowners who received a mortgage modification to better understand the impact of modifications on homeowner behavior.

使用抵押贷款, 信用卡, 以及来自大通银行客户样本的存款账户数据, 我们调查了抵押贷款修改计划的不同特征的相对重要性. 特别是, we studied the impact of reductions in monthly mortgage payments and principal on 默认的 and consumption.

找到一个: Payment reduction for borrowers with similar payment burdens varied by two to three times across different modification programs.

Borrowers with similar payment burdens (as measured by pre-modification mortgage payment-to-income ratio, or PTI) received considerably different payment reductions depending on the modification they received:

- Borrowers with a high mortgage PTI (above 50 percent) received more than twice the payment reduction from HAMP (55 percent) compared to the GSE program (27 percent).*

- Borrowers with a low mortgage PTI received three times the payment reduction from the GSE program (25 percent) compared to HAMP (8 percent).

*HAMP refers to the Home Affordable Modification Program introduced by the Federal Government and the GSE program refers to the proprietary modifications offered by the Government Sponsored Enterprises Fannie Mae and Freddie Mac.

发现三: 对于仍然资不抵债的借款人来说,减少抵押贷款本金对违约没有影响.

There was no difference between the post-modification 默认的 rates of borrowers who received principal plus payment reduction and borrowers who received only payment reduction. This finding suggests that “strategic 默认的” was not the primary driver of 默认的 decisions for these underwater borrowers, meaning that they were not 默认的ing simply because they owed more on their mortgage than their house was worth.

发现四: 对于仍然资不抵债的借款人,抵押贷款本金的减少对消费没有影响.

结论

在这份报告中, 我们衡量了抵押贷款支付和本金减少对违约和消费的影响. 我们的研究结果对住房政策和货币政策都有启示.

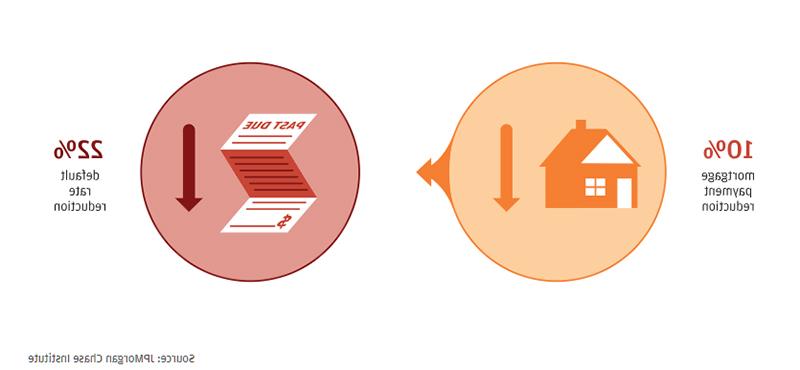

Our findings suggest that mortgage modification programs that are designed to target substantial payment reduction will be most effective at reducing mortgage 默认的 rates. Modification programs designed to reach affordability targets based on debt-to-income measures without regard to payment reduction will be less effective. Principal focused mortgage debt reduction programs that target a specific LTV ratio but leave borrowers underwater will also be less effective at reducing 默认的s.

在某种程度上,抵押贷款的修改可以被视为重新发起, 我们的发现可能也适用于承保标准. The fact that 默认的 was correlated with income loss provides evidence that static affordability measures such as debt-to-income ratio were not a good predictor of 默认的. 高抵押贷款和低抵押贷款PTI借款人在违约前都经历了类似的收入下降, suggesting that even among those borrowers whose mortgages would be categorized as unaffordable by conventional standards, 引发违约的是收入下降,而不是高水平的支付负担. 因此, policies that help borrowers establish and maintain a suitable cash buffer that can be drawn down in the event of an income shock or an expense spike could be an effective tool to prevent mortgage 默认的.

The housing wealth effect is one of the important mechanisms that transmits changes in monetary policy to household consumption. 这种传导机制依赖于导致房价上涨的宽松货币政策, 而房地产财富的增加反过来又刺激了消费. The lack of consumption response from underwater borrowers to principal reductions suggests that the marginal propensity to consume out of housing wealth is nearly zero for these homeowners. For underwater borrowers, the inability to translate increased home equity into liquid resources (e.g., through equity extraction) may nullify the housing wealth effect and thus constrain this transmission mechanism.